The reason that cultures with a high degree of risk-avoidance do few type B-investments is that they can always save the investment and thereby avoiding the risk of failure and since they are “only” foregoing an opportunity and the consequences are not deadly, they seem better off in the short term when applying this principle.

Everything we do is associated with a certain degree of risk. Some of this risk is completely outside our control and impossible to mitigate, like getting hit from behind when we stop on red at a traffic light. Completely avoiding risk requires a degree of isolation that very few are willing to accept. Instead, we work together minimizing the risk through cooperation and legislation and we take our own individual precautions like fastening the seat belt when driving a car and wearing a helmet when we ski or ride a bike. We try to foresee what can go wrong and we have strategies and procedures for managing the most probable unwanted outcomes of our projects and activities. The more severe the consequences of an unwanted outcome the more rigid the control systems we establish to minimize the risk. The control systems surrounding nuclear power plants and air traffic are extremely comprehensive, minimizing the risk of failure and subsequent loss of limbs and lives.

Managing and mitigating risk in business projects

In business we constantly have the opportunity of investing in new projects that may improve our competitive position, grow our company in some way or provide other advantages that will yield an attractive pay back some time in the future. All these initiatives may fail and if they do we may be worse off compared to the situation where we did nothing. As a matter of fact all investments will always have a negative impact on our short term position since we have just committed resources to an activity and these resources are not available for other opportunities that may suddenly pop up.

Risk and culture

There are basically two types of investments we can do:

A. Investments initiated to mitigate threats or reduce cost

B. Investments initiated to pursue a promising opportunity

The A-type investments enjoy high priority in all companies in all cultures, while the volume of B-type investments are very depending on the cultural environment.

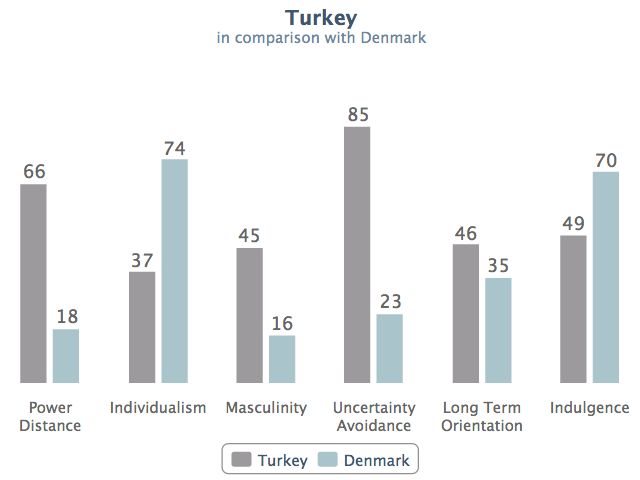

The Hofstede Center defines and monitors six cultural dimensions in all countries around the globe and one of them is risk-avoidance. Cultures with a high degree of risk-avoidance will be more driven towards A-type investments while cultures with a low degree of risk-avoidance will do a fair amount of B-type investments also.

The reason that cultures with a high degree of risk-avoidance do few type B-investments is that they can always save the investment and thereby avoiding the risk of failure and since they are “only” foregoing an opportunity and the consequences are not deadly, they seem better off in the short term when applying this principle.

The paradox is that the more B-type investments we do, the less A-type investments will be forced upon us. The more we pursue opportunities the better are the chances that we grow and improve both our competitive capacity and our ability to maneuver when the going gets tough. If we never invest in pursuing opportunities because they may fail then we will slowly sink into reactive mode where we have little experience with driving change and where we learn nothing since we never try anything new and risky.

I have articulated this propensity in Bech’s 3rd law: “If doing nothing is acceptable, then “doing nothing” will be done.” This law applies in all cultures, but the law applies more often in cultures with a high degree of risk-avoidance.