– Why it doesn’t work and what you could do instead.

I am assisting software companies with internationalisation. What that comes down to is helping our clients acquire customers in a new market (bootstrapping), building a local presence (bridgehead) and heading for market dominance (scaling) [1].

Before jumping to the subject of this post let me clarify a few things.

The clients I am assisting all have high price/low volume type of software solutions. They need to get sales people in front of potential customers in order to get the sales/purchase process rolling. Sales cycles are highly unpredictable, but always somewhere between 6 and 24 months.

I often get approached by software companies who would like me to take their products to the market either directly or through a channel of value added resellers, systems integrators or maybe even a 3-tier model. And they offer to pay us a share of the revenue generated through this effort. Basically what they are saying is: “We don’t want to listen to all your consulting theory or read your nice reports; get us some customers and we will pay you with a share of the revenue you generate for us.”

This blog post will explain why this model is doomed to fail, at least in the western world and what you could do instead.

No investment = no action.

Taking a product to the market is never a walk in the park. Taking a new product to new customers in a new market is probably one of the most difficult and risky endeavors any company can face. If you are IBM, HP, Apple, Oracle, SAP or Microsoft it may be different or at least you can afford big investments (and cover big mistakes and gigantic losses). But if you are Joe Blogs with a 250 people company in country X and you want to get into Germany: “Blogs muss sich warm anziehen”. Moving ahead with a strategy of finding someone who will penetrate the market for you and get paid in 12-24 months when the first customer signs (maybe) is a suicide mission. Here are the reasons why:

- Taking a new product to new customers in a new market calls for super sales people. Super sales people are rare and they already have good and well-paid jobs. If they do not have a job I can guarantee that they can get a € 200.000+/year job within 3 months. Why on earth should a super sales person take on a risky project, which may pay off in 12-24 months? (Your comments to this question will be highly appreciated.)

- Let’s just assume that there is a cowboy out there ready to take on your “value proposition”. Isn’t it fair to assume that he will expect to make much more than € 200,000 a year? If he doesn’t make anything the first year, we must assume that he expects to make € 6-800,000 the second year. Obviously someone who is to take the full risk will expect to get a considerable premium as opposed to the situation, where the risk is shared. A magnitude of 2 is not unreasonable.

- Why should he choose your company? Anyone prepared to work on such conditions can pick and choose virtually any vendor to work for. Just give 3 good reasons why you are his best choice.

- Is your business model supporting this level of remuneration?

- You will find someone who is willing to work for a small retainer and a big commission, but they will not be the best suited for the job and they will be working on “5” other assignments compensating for the risk associated with your project.

- You are not committed. If you are not committed to bringing your own product to a new market, you will not respect the guy working for you and you will not go through water and fire to help him succeed. By being unwilling to make any investments yourself you might as well shout out loud, “I think the risk associated with selling my product in this market is extremely high. Is anyone else prepared to try?”

The reseller approach

Most software companies are trying to recruit “business partners” (distributors, resellers or system integrators). The assumption is that these partners have a portfolio of existing customers where the solution will fit. Unfortunately the success rate of this approach is extremely low. The reasons are the following:

- The resellers are reluctant to take your solution to their existing customers. They consider the risk too high. They don’t know your solution very well and they have little experience with you. They fear that promoting your solution to their existing client may jeopardise their customer relationship. They would rather try out your solution on new potential customers.

- Resellers are not sales eagles. Only very few of them employ super salespeople. Few of them are capable of selling a new solution to a new customer.

Share of value versus share of revenue

Let’s assume that you do have an attractive customer value proposition and that your solution is extremely competitive. Let’s also assume that you know exactly how to sell the product, that your references are second to none, that your business model is scalable and that you have a realistic exit plan. Then you could go for a joint venture model. The joint venture model gives your local partner a share of the value created instead of just a share of the revenue created.

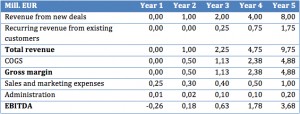

Let’s assume a P&L scenario as the following:

How much would this business be worth if you were to sell it by the end of year 5? [2]

The Joint Venture

Thus a joint venture, where you buy out the joint venture partner in year five with his share of the value created is a completely different story.

The joint venture model can take many forms and shapes. It can be organised as an independent company, as a subsidiary or as a franchise. The crucial issues are the focus, the brand and the exit. The joint venture partner is seldom a single person, but rather an existing company or group of people, who have the competence, the funds and the energy it takes to get a business going.

There are obviously also issues related to the joint venture approach. Some of these are:

Higher level of commitment/exclusivity

Anybody investing a considerable amount of energy and resources into a new business venture will look for ways to protect the investment. If you embark on the joint venture model you must help your joint venture partner with this investment protection. However you should never accept that the joint venture partner is engaged in other activities. The risk of defocus is simply too high.

Joint venture partners are very difficult to find and hard to recruit.

It will take time to find the right joint venture partner. There are not many available and the “recruitment” channels are less developed. When you find them you will realise that they are tough business people. They may not want to sign your “standard agreement”, but have their own ideas about what the deal should look like.

If it doesn’t work.

If you choose the wrong partner and/or the relationship doesn’t work it is painful and difficult to terminate.

Require high standards on your side.

Joint venture partners will give you a hard time if you don’t keep up excellent support and stay ahead with product development in order to remain competitive.

The life cycle issue.

The joint venture partner you sign up may be the right one to break the new market, but will he also be the right partner to make it in the new market? How do you ensure that your JV partner is prepared to step aside when he suddenly is “a part of the problem”?

Concluding remarks.

When you do not have the funds to do it all by yourself I recommend considering the joint venture/franchise approach as a way to accelerate new market penetration. Getting a share of the value rather than just a share of the revenue makes a very big difference.

Notes:

- Whether the business model is direct or indirect really doesn’t make any difference. By the end of the day only the end-customer pays the bills!

- You can easily see that the model makes the “commission only” approach very difficult. It is almost impossible to finance the compensation for shifting the full risk to agent/reseller.

Pingback: Increase your prices - part 8: Pricing | Helping companies grow